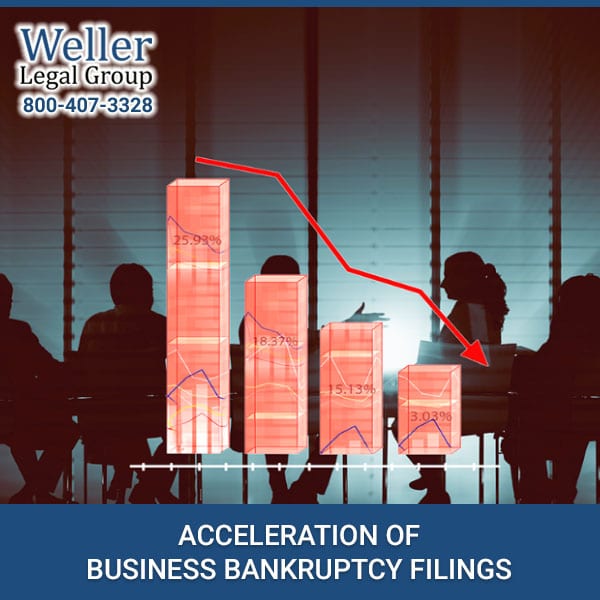

Running a profitable business is always hard work, and unfortunately, the coronavirus pandemic has made it even harder. The number of businesses that have filed for bankruptcy has skyrocketed since lockdowns began, and the rate has shown few signs of slowing. Business bankruptcy filing rates this year have been the highest since 2013 and surging cases of Covid-19 across America point to the elevated rates remaining high for the foreseeable future. If you own a business that is struggling with debt due to the coronavirus pandemic, it may be a very stressful time for you. Fortunately, there are a few steps you can take in order to protect your business.

Running a profitable business is always hard work, and unfortunately, the coronavirus pandemic has made it even harder. The number of businesses that have filed for bankruptcy has skyrocketed since lockdowns began, and the rate has shown few signs of slowing. Business bankruptcy filing rates this year have been the highest since 2013 and surging cases of Covid-19 across America point to the elevated rates remaining high for the foreseeable future. If you own a business that is struggling with debt due to the coronavirus pandemic, it may be a very stressful time for you. Fortunately, there are a few steps you can take in order to protect your business.

State-wide lockdowns have had the most detrimental effect on businesses, but they have not been the only cause of reduced business. Even in the reopened state, high unemployment leads to fewer people spending money, and the risk of infection leads to fewer people going out for unnecessary reasons. Federal programs so far have only been able to provide limited relief, with rollout being flawed at best. Programs like the Paycheck Protection Program (PPP) have been first-come, first-serve rather than need-based, leading uneven distribution of funds.

Chapter 11 Filings

Chapter 11 bankruptcy is a particularly attractive form of business bankruptcy because it allows the company to continue operations while they reorganize their debt. It can also allow them to qualify for new financing which can go a long way in helping a business survive.

In the post-coronavirus economy, several well-known corporations such as Hertz, Crew, C. Penney, Chesapeake EnergyGold’s Gym, and Cirque Du Soleil have all filed for chapter 11 bankruptcy protection. Others, like AMC theatres, are reportedly on the verge of filing as well. Entertainment companies, gyms, and travel-related businesses are all heavily at risk during the pandemic as they are some of the first required to shut-down in the event of a state-wide lockdown.

Looking to the Future

The highest rates of chapter 11 bankruptcy filings came during the 2008 financial crisis and recession. However, current rates of business bankruptcy may soon overtake that record. For comparison, the first have of 2020 has seen almost the same number of chapter 11 filings as the first half of 2008. With no clear end in sight for the coronavirus pandemic and a potential second wave on the horizon, filings will most likely continue to increase. If a second wave results in further lockdowns, businesses that survived the first wave may be forced to close permanently.

Chapter 11 bankruptcy is more likely to affect small businesses than large corporations, a trend which has been noted by Business Insider. According to a recent report, larger companies are more likely to be in a position to borrow money in order to survive the decrease in business. They have particularly taken advantage of Investment Grade Bonds, which hit $1 billion in sales in May of this year, setting the record for annual sales. The pandemic has led to a decrease in loan interest rates, making many businesses more willing to take on loans. Smaller companies, on the other hand, may not be able to take advantage of loans and are more likely to file for chapter 11. They may also need to liquidate all of their assets.

What are Your Options?

Filing for business bankruptcy can be difficult, and exact circumstances will determine whether filing for Chapter 11 protections or liquidation is best for your business. If you are considering filing for business bankruptcy, Weller Legal Group can help you determine the best way to file for your set of circumstances. Reach out today to discuss your options with one of our experts.

Picture Credit: Freepik