Iconic arms manufacturer Remington Outdoor Company (operated for nearly two hundred years as the Remington Arms Company) is on the brink of filing a voluntary petition for Chapter 11 bankruptcy. Remington Outdoor is headquartered in Madison, NC.

The company’s original intent was to begin solicitation for the plan on March 5, 2018, with the bankruptcy filing to follow on March 7th. Those dates were set back one week (March 12th for start of solicitation and March 14th for filing for Chapter 11 protection) after Bank ofAmerica backed away from a key financial role in the reorganization plan.

Current Ownership of Remington Outdoor:

Current Ownership of Remington Outdoor:

The Remington Outdoor Company was purchased by Cerberus (*) Capital Management in 2007. Cerberus Capital Management is headquartered in New York City. The company’s website describes the company as “…a private investment firm…with affiliate and advisory offices across the United States, Europe and Asia…”. The firm is led by CEO Steve Feinberg, the co-founder of the company along with William L. Richter. Richter serves as the company’s Senior Managing Director.

[ (*) “Cerberus” is the mythological three-headed dog that is depicted as the guardian to the gates of Hades]

Company CEO Feinberg is a graduate of Princeton University. Some accounts depict Feinberg as a business innovator and an astute business man “…with a ‘colored past’…”. (emphasis added) In his early career, Feinberg worked for the now-defunct investment bank Drexel Burnham Lambert (“DBL”).

In February, 1990, DBL collapsed and was forced into bankruptcy, primarily because of the illegal activities of trader Michael Milken (the “junk bond king”). Milken, head of DBL’s bond department in the 1980’s, eventually pled guilty to securities fraud. Milken paid some of the largest fraud-related fines levied until that time and was sent to prison for two years. Friends of Feinberg have reportedly said that “his association with Drexel Burnham, the way the company foundered and folded, is carried by Steve like a ‘stain’…”.

Other noteworthy companies owned by Cerberus include: Aozora Bank; GMAC Financial Services; North American Bus Industries; BlueLinx; Tower Automotive; Peguform Group; and Spyglass Entertainment

In the Summer of 2007, Cerberus agreed to buy the world’s largest equipment rental company, United Rentals, Inc. (“URI”). Because of worsening credit markets at the time, Cerberus attempted to cancel the acquisition and offered to pay United Rentals a pre-negotiated “reverse termination fee” that was a part of their agreement. United sued for specific performance of the acquisition agreement… and… lost. The Court ruled in Cerberus’ favor, writing in its ruling “…URI knew or should have known what Cerberus understanding of the merger agreement was…”.

In May, 2007 Cerberus purchased control (80.1%) of Chrysler automotive, paying $7.1 billion to Daimler-Benz. Cerberus was a “proud owner” of Chrysler until the economy took a nose-dive in 2008 – 2009. In the Spring of 2009, Chrysler was forced into Chapter 11 bankruptcy. In June of that year, the bankruptcy court ruled that Cerberus had to sell all of its assets to Italy’s Fiat automotive. Cerberus’ investor clients were unnerved enough to draw away. As a result, seventy-seven percent (77%) of its hedge fund assets all-but-vanished almost overnight.

Around that same time Cerberus experienced trouble with its GMAC holdings, which resulted in Cerberus’ loss of a majority of its stake in the lending company. In short, the years leading up to 2010 were anything but banner years for Cerberus and its investors/clients.

Today, Cerberus has in excess of $40 billion in assets under management (“AUM”) in accounts and funds. The company’s areas of focus are wide and varied, including: financial services; healthcare; travel and leisure; weaponry; government services; Consumer and Retail; industrial and automotive; real estate; manufacturing and distribution; technology and telecommunications; commercial services; transportation; energy and natural resources; apparel; paper; and packaging and printing.

History of Remington – 19th Century:

The company – billed as “…one of the oldest manufacturers of firearms and the largest U.S. producer of rifles” – was founded in 1816 by Eliphalet Remington, Jr. in Ilion, New York. Eliphalet the younger was born in Connecticut in 1793, the son of Eliphalet, Sr. and Elizabeth Remington

Soon after hand-forging his first firearm, Eliphalet, Jr. began making rifles for men in and around Ilion, NY. The purchasers were impressed with the quality and craftsmanship of Remington’s “homemade” rifles. His sales went from a few here and there to hundreds. As his business grew, the younger and the older Remington’s began shipping their rifles throughout 18th century New England. The Ilion factory was built on the Erie Canal, providing easy, ready and cheap access to numerous locations of commerce where the Remington reputation for quality rifles and sound business grew apace with their company and sales.

Throughout the 1820’s and ‘30’s, continuing growth made the Remington enterprise the largest manufacturer of rifles in the United States. In 1845, Remington Arms successfully bid on its first government contract.

In the ensuing 100 years, the number of government arms contracts would explode. Remington Arms was a major supplier of arms to the government for all U.S. wars with the exception of the American Revolution.

At its formal founding in 1856,the company carried the name E. Remington and Sons, having been named after Eliphalet, Jr. and his own three sons.

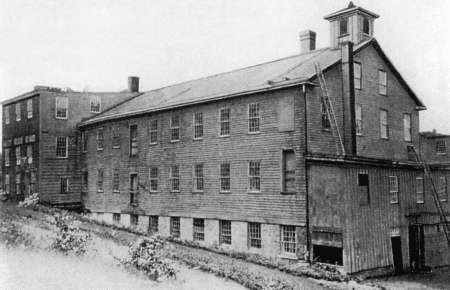

The company’s factory in Ilion, NY (picture, at right, shows the Ilion factory circa late 20th century) is still sited on the land where the original company was started in 1828. Remington also has production facilities in Lonoke, AR, Hickory, NC, and Huntsville, AL. Eliphalet, Sr. was killed in a freak accident while transporting supplies to the Ilion factory site shortly before it was completed in 1829.

The company’s factory in Ilion, NY (picture, at right, shows the Ilion factory circa late 20th century) is still sited on the land where the original company was started in 1828. Remington also has production facilities in Lonoke, AR, Hickory, NC, and Huntsville, AL. Eliphalet, Sr. was killed in a freak accident while transporting supplies to the Ilion factory site shortly before it was completed in 1829.

When a major downturn came in the early 1800’s, Remington began diversifying into other areas of manufacturing such as:

- Baxter steam-powered streetcars (and later, Baxter steam canal boats) under contract

- Velocipedes (early bicycles) – Remington is credited with creating the domestic bicycle industry

- Specialized sewing machines and related devices

- Typewriters (the first mass-produced models in the U.S.)

- Other innovative areas, including: cigar-making machines; electric lighting systems; gas-powered engines; burglar alarms; deep-well pumps; and lathes to name just a few

The company experienced explosive growth during the American Civil War – it was the major arms supplier for the Union side in the conflict. Remington Arms produced over $3 million worth of rifles during the war. At one time during that period every man and boy in Ilion, NY was working to fulfill Remington’s federal arms contracts.

The end of the Civil War saw a dip in both production and sales. That didn’t last long as the company expanded its reach overseas, into new and emerging markets, and continued sales to the U.S. government. During the 1870’s the company’s production came to exceed the entire arms production of England. At one point, the Ilion factory was producing 1,400 riles and 200 sidearms per day.

The decade of the 1880’s saw several setbacks for the company as the economy weakened for everyone. The “Great Chicago Fire” of 1874 destroyed the Remington sewing machine factory, Samuel died in 1882, and things continued to worsen until, in 1886. the company filed for bankruptcy, an action that had a devastating effect on the family as well as the town of Ilion. In 1888, E. Remington & Sons was sold to a partnership that was led by a former Remington Salesman, Marcellus Hartley.

Philo died in 1889, while Eliphalet III lived on into the 20th century, dying in 1924 after the company had recovered and become the Remington Arms Company.

History of Remington – 20th Century:

At the turn of the 20th century, the fortunes of the Remington company improved considerably. First, an order for 100,000 rifles for the government’s fight in the Spanish-American War was a boon. Second, it sold off its flagging bicycle manufacturing operations. And third, it began a program of diversification in other companies that it owned. In 1903 it renamed its Remington Typewriter Company (formerly the Remington Standard Typewriter Company), and later used it to create a larger, more diverse office equipment company in 1927 – Remington Rand, Inc.

Remington also prospered significantly during World War I. At its peak during the war, the company was turning out more than 3,000 rifles per day, with production of other arms growing as well. The number of Remington employees grew from about 900 pre-war to over 11,000 after the United States entered into the conflict. The number of employees reached 15,000 by the time the war ended in 1918.

After the war – despite a post-war slump that was inevitable – business for Remington continued apace and remained solid. Solid, that is, until the Wall Street crash of 1929 signaled the onset of the Great Depression. By the early ‘30’s, Remington employed only 300 workers at the Ilion, NY factory, and business was lagging badly. In 1933, Remington sold a majority interest (60%) to E.I. du Pont de Nemours & Company, a manufacturer of gunpowder and explosives that was founded in 1802.

The corporate marriage with du Pont came at the right time to ensure that Remington was well-positioned to take advantage of the economic boom that came with World War II. During the war, Remington added 9,000 employees to its payroll and operated its production facilities 24-hours per day, 7-days per week. Production of its famed Springfield rifle exceeded more than 1,000,000 during the early years of the war. In 1942, the company celebrated the 2 millionth sale of the Springfield rifle. As with WW I, the second World War proved to be good business for Remington and du Pont.

After the war, the company continued to fill government contracts while, at the same time, expanding into manufacture and sales of sporting rifles and shotguns. To help counteract waning post-war profits, the company branched out again into new markets – hunting knives and Remington shavers, household utensils and tools (such as its “cartridge-powered stud driver”, a forerunner of the electric nail guns of today) – while continuing with its sewing machine enterprises and Remington Rand, Inc.’s line of products. By 1980, sales were over $300 million annually (dropping to under $200 million by 1986) and du Pont became 100% owner by purchasing the remaining 40% equity in the company.

By 1992, Remington, then under the complete ownership of du Pont, posted annual sales of $400 million, double the 1986 figure. The following year, du Pont surprised the arms industry community by selling its Remington holdings in a leveraged buyout. The buyer was a private investment group, Clayton, Dubilier & Rice, Inc.(“CD&R”)

CD&R, founded in 1978 as a private equity investment firm, has managed the investment in over fifty-two businesses with a total portfolio value in excess of $17 billion. Principals in the company are the founding members Eugene Clayton, Martin H. Dubilier, and Joseph L. Rice, III.

CD&R holds equity positions in some highly recognizable brands. Including:

- Emergency Medical Services Corporation

- Rexel

- US Foods

Over the years, the company sold or traded its stake in a number of other well-regarded brands, including:

- Remington Arms

- VWR International

- Uniroyal Goodrich Tire Company

- Lexmark

- The Hertz Corporation

- FedEx Office (previously, FedEx Kinko’s)

- Sally Beauty

Historically, CD&R has invested in a broad range of industries, with over sixty-percent (60%) of its transactions involving divestitures. The aggregate transaction total of its investments since 1978 is in excess of $80 billion.

History of Remington – Close of the 20th& Opening of the 21st Centuries:

The history of Remington under the ownership of CD& R was neither healthy nor particularly profitable. A number of risky and unwise moves during CD&R’s ownership were damaging to Remington’s legacy of innovation and quality. The 1996 opening of a new research and development center – at a cost of over $5 million – in Elizabethtown, KY proved to be a waste of corporate money. Likewise, with the company’s intention of consolidating operations, lowering production costs, and actively opposing federal and state legislation related to gun-owner’s and their 2nd Amendment “rights” – all fell short of expectations and somewhat tarnished the once-sterling reputation of Remington Arms.

Toward the end of the ‘90’s, the parent company moved Remington’s corporate headquarters from Ilion, NY to rural Madison, NC. In 1997, in a further attempt to expand into a more rural, “hunter-friendly” locale, Remington opened a new factory in Mayfield, KY (an area even more rural than the site of its North Carolina headquarters). The Mayfield production facility was the first new Remington plant to open since 1828. These two decisions were driven not by the leadership of Remington but, rather, by the executives at CD&R.

History of Remington Under Cerberus Capital Management (2007 to Present):

CD&R’s attempt to locate a buyer for its Remington holdings finally bore fruit in 2007. In June of that year CD&R sold Remington to Cerberus Capital Management in a leveraged buyout transaction worth $370 million – $250 million of the total was in the form of assumed debt. Shortly after closing the deal, Cerberus changed the name of Remington Arms to Freedom Group as it rolled all of its arms-related businesses – Bushmaster Firearms International, DPMS Panther Arms, Marlin Firearms, Advanced Armament Corporation and Remington – into that one umbrella company.

In 2014, the company began construction on a new state-of-the-art manufacturing facility in Huntsville, AL to produce two arms products that were formerly made at the Ilion, NY factory. In 2015, the Freedom Group of companies was renamed Remington Outdoor Company to focus attention and sales on a wider array of outdoor-centered products such as fishing equipment, camping gear, and the like. Firearms still comprise the lion’s share of Remington’s core sales – today, Remington Outdoor manufactures over 100 different firearms that include bolt-action rifles, pump-action rifles, automatic, semi-automatic and single-shot rifles, shotguns (pump-action, break-action and semi-automatic), and handguns (semi-automatic, revolvers and others such as the iconic Derringer pistols).

History of Remington – The 21st Century “path to Bankruptcy”:

Twice in its recent history – once in the early 1990’s, and again in 2007 – Remington was bought by outside interests in leveraged buyout(“LBO”) transactions. Recently, after Remington Outdoor spoke of filing for Chapter 11 bankruptcy, some industry analysts opined that those LBO transactions, separate and apart from other problems the company might have had at any given time, “…put Remington on the almost-inevitable ‘path’ to bankruptcy”.

The 2007 leveraged buyout of Remington Arms by Cerberus Capital Management put approximately $1 billion in debt on to the books of Remington. While other factors have played a larger role in the current financial straits of the company, that debt remains in large part and is part of the pre-packaged restructuring deal being taken into bankruptcy by the parent company.

History of Remington – The “Reality of Bankruptcy” in 2018:

Today (3/10/2018) Remington Outdoor is four days from filing its Chapter 11 bankruptcy petition in bankruptcy court in Delaware. According to a statement released last week by a company spokesperson in advance of the bankruptcy filing, “Holders of Remington’s $550 million term bonds will get an 82.5% equity stake in the company. Third-lien note holders will receive a 17.5% equity stake, while four-year warrants receive a 15% equity interest…”. Other sources say that a group of Remington’s creditors will provide a $100 million “debtor-in-possession” loan to finance continuing operations during the pendency of the bankruptcy proceedings.

Photo credit: wikimedia- PJM, wikimedia-Karl-Heinz Rauscher