lev·er·aged buy·out

ˌlev(ə)rijd ˈbīˌout/ – noun

Plural noun: leveraged buyouts

- The purchase of a controlling share of a company by its management, using outside capital

A leveraged buyout (“LBO”) is the acquisition of one company (or division of a “target” company) by another outside company using a significant amount of borrowed money to finance the acquisition.

The purpose of a leveraged buyout is to allow companies to make very large acquisitions without having to commit a lot of upfront capital. The assets of the “target” are used as collateral for the loans taken out for the purchase by the acquiring company.

This article will serve to give an overview of LBO’s – their history, their uses, misuses, and abuses – as well as relate their use in corporate “takeovers” to the venture capital firm,Bain Capital. Finally, this article will show the impact that a significant number of LBO’s have had on companies that have been driven into bankruptcy as a result of this “financing technique”.

Characteristics Of Leveraged Buyouts:

Analysts are unclear when the first leveraged buyout occurred, but it is generally agreed that bootstrap acquisitions(as LBO’s were knownin the early days) began in the years following the Second World War. Between that time and the early 1980’s, LBO’s were more of an obscure financing method – that was little used and not well understood. LBOs have become a common financing “tool”; as they became in the ‘80’s, ‘90’s and into the new century.

In the years following the great depression, America’s corporate leaders were not of the mind or in the mood to have high corporate debt ratios. As a result, for the first three decades following the end of World War II, very few domestic companies relied on debt as a significant source of funding. In the early 1960’s, the focus was on building corporate “conglomerates” that saw the growth and expansion of such corporate empires as General Motors, General Electric, and a whole raft of defense-related giants.

LBO’s did not start to take off as a source of acquisition financing until 1980. In that year, there were four leveraged buyout deals with an aggregate value of just $1.7 billion total (an average of $425 million per transaction). Contrast that to the activity in 1988, a year that recorded four-hundred ten buyout deals with an aggregate value of $188 billion (an average of $458+ billion per transaction). 1988 was the high-point for leveraged buyouts – several factors combined in the ensuing years to make LBO’s less attractive, riskier and, thus, less of an option as before.

According to a study done by the Center for Private Equity and Entrepreneurship (Tuck School of Business at Dartmouth University), between 1980 and 1988, private equity LBO funds raised in the neighborhood of $46 billion. Between 1988 and 2000, that figure stood at over $385 billion raised – an impressive 88% increase in LBO funds raised in just twelve years.

The attractions of LBO’s as acquisition vehicles came about, in large part, due to the excesses of corporate leaders who were bent on building conglomerates in a wave of “empire building” that began in the ‘60’s and peaked in the 1970’s. At the time, executives filled their corporate boards with trusted subordinates and “friendly outsiders”. Big businesses got bigger but their profitability took a nose dive. It was in that already-charged environment that the modern-day LBO’s took root and the “raiders” of private equity became ascendant.

It has been said that “every leveraged buyout is unique with respect to its specific capital structure…”. The “common element” with all LBO’s is the use of financial leverage to accomplish the purchase of a target company. When a private equity firm sets its sights on a target, the financing tools include a combination of debt and equity to complete the acquisition. The typical LBO debt-to-equity ratio has been in the range of 90% debt to 10% equity.

The bonds that are issued to back such deals are not of high quality (“junk bond financing”) and are below investment grade. “Junk bond financing” has been repeatedly criticized as a predatory tactic and such moves have been fairly uniformly resisted by target companies. The target company’s business success and positive balance sheet numbers are used against it as collateral for a hostile outsider’s self-serving motives.

In most LBO scenarios the target company is healthy, profitable and growing in the period leading up to the targeted takeover. LBO’s are conducted for three primary reasons: to take a public company private, to spin-off a portion (division, subsidiary, etc.) of an existing business in a sale, orto transfer private property as with a change in small business ownership.

Because of the high debt-to-equity ratios in most LBO’s, the history of their use has led to many ending with the targeted company falling into bankruptcy. With leverage ratios close to 100%, interest payments on the financing obligations – carried on the books of the acquired companies – was too great to be serviceable from operating cash flows. At that point, such companies had little choice other than to pursue bankruptcy protection.

In the late 1970’s and early ‘80’s, the rise of private equity firms began when so-called “savvy investors” (i.e. “predators”, “corporate raiders”, and the like) saw and seized the opportunities to profit from inefficient, under-performing, and undervalued company assets. The “play” soon began to focus on public companies that were then trading at a high discount to net asset value – this made them desirable targets for “raiders” who saw the “profitability” (for the raiding company) in buying an entire company, breaking it up, and selling off assets while doing nothing with the debt until the latter was disposed of through bankruptcy. Such tactic has been called the “bust up” approach to acquisitions – late in the 1980’s, the approach led to a public and media backlash against LBO’s and the corporate raiders who utilized them in such a manner.

The public soon came to know that corporate “raiding” via LBO’s and other related predatory tactics was not totally acceptable for the targeted companies or the public writ large. In the mid-1980’s to the late ‘90’s this discontent was recorded in both print and on the big screen. The book by Wall Street Journal reporter Jeffrey A. Trachtenberg – The Rain on Macy’s Parade: How Greed, Ambition, and Folly Ruined America’s Greatest Store (released January, 1996) is the tale of one LBO gone bad. One review, at the time, said, (the book) “…is the inside story of how Macy’s executives launched the largest leveraged buyout in retail history and brought the company to its knees.”

Released in 1987, the Oliver Stone movie Wall Street won an Academy Award for Best Actor for its male star, Michael Douglas (actress Daryl Hannah won a Razzie Award for Worst Supporting Actress for her role in the movie; Wall Street is the only movie in history to win awards for Best and Worst actor in the same picture). Reviews of the film were uniformly good, with one critic stating that the overarching theme is“…a film that has come to be seen as the archetypal portrayal of 1980’s excess… with (the male star) advocating for the proposition that ‘greed is good’…” (a major speech by Michael Douglas is known today as the “Greed is Good speech” scene).

Another structured finance-themed movie of the day is Barbarians at the Gate, a movie made for television that was based on a book about the leveraged buyout of RJR Nabisco. The LBO took place in a public row for control of the company that occurred in October and November, 1988. At the time, the RJR Nabisco leveraged buyout was widely considered to be “…the preeminent example of corporate and executive greed…” of the day.

Despite the public outcry, many private equity firms resisted the challenges because they saw that advantages to LBO’s could outweigh the onslaught of negative publicity and calls for action. The advantages to using LBO’s, from a raider’s perspective, include:

- Tax advantages associated with debt financing

- Freedom from scrutiny of being a public company (or a captive division of a larger parent company)

- The ability for takeover executives to take advantage of liquidity (while not having to give up operational influence or continuing day-to-day authority over operations)

- The likelihood of managers taking over ownership of a great portion of a company’s equity (“lining of pockets”)

Time and testing in the marketplace over the years have shown that there are many advantages – for the dominant company in a given transaction – to Leveraged Buyout financing.The number of advantages to the use of leverage in acquisitions include: large interest and principal payments often force management to improve performance and operating efficiency, “discipline of debt” theory can force management to focus on “positive initiatives” such as divestiture of non-core businesses or divisions, downsizing, cutting costs and / or investing in technological upgrades, and using debt in a manner that serves both as a financing technique and as a tool to force changes in corporate / managerial behavior.

Additionally, as the debt ratio increases, the equity portion of the acquisition financing shrinks to a level where a private equity firm can acquire the target company by putting up only 20% to 40% of the total purchase price. At the same time, the acquiring company often forces the management of the target company to invest in the deal with their own personal assets – this assures that those managers have “skin in the game” and will align their incentives with those of the acquiring company.

The minute details of LBO’s are too complicated to cover in this article. The types and levels of debt are themselves complicated and woven throughout any given LBO. In a leveraged buyout, the target company’s existing debt is usually refinanced – in some instances, such debt is rolled over – and replaced with new debt to finance the transaction. Multiple tranches of debt are commonly used to finance LBO’s and may include several different types. In the world of structured finance, a tranche is one of a number of related securities offered as part of the same transaction. The word “tranche” is French for “slice”, “series”, “section” or “portion” – in an LBO each bond or security is a “slice” or “section (a “tranche”) of the deal’s overall risk.

Going in to a given LBO, the acquiring company usually has an “exit strategy” whereby the private equity firm seeks to exit their investment in five to seven years after acquisition. This is not a “rule” or something that is hard-and-fast. An exit usually involves either a sale of the targeted, acquired company, an Initial Public Offering (“IPO”), or a recapitalization of the transaction by effectively re-leveraging the company in an acquisition deal by a different LBO firm.

In structured finance deals, most are set up as limited partnerships. A limited partnership (also known as limited liability partnerships -LLP’s) is where two or more partners unite to jointly conduct business, such as in an LBO transaction, and where one or more of the partners is liable only to the extent of his or her investment in the venture. In an LLP, there must be at least one General Partner and at least one Limited Partner. The limited partners must be qualified investors pursuant to rules set by, monitored, and enforced by the Securities and Exchange Commission (“SEC”); such strictures require a certain net worth or income at certain levels in the prior two years before the transaction ensues. The principals of the LBO private equity firm serve as the general partners, while the investors in the fund – usually investment funds, insurance companies, pension funds and very wealthy people – are the limited partners. A Genera Partner is responsible for making all investment decisions of the enterprise, while the role of the limited partner is to transfer committed capital to the fund according to terms of the partnership agreement.

The following discussion will highlight the most common and fairly standard provisions governing the use of funds raised by private equity firms for limited partnership acquisitions:

Minimum Commitment: Prospective limited partners required to commit a minimum amount of equity (a “capital commitment” that is drawn down in a “takedown” or “capital call” by the general partner to use such funds to make investments on behalf of the fund…)

Investment/Commitment Period: Time in which limited partners are obligated to meet “capital calls” by transferring agreed upon sums to the fund (subject to time limits and total amount of capital required as agreed upon)

Term: The life of the investment fund – usually 10 to 12 years – with the first half comprising the “commitment period” and the second half being for managing and exiting the fund

Diversification: Limit placed on how much of a fund’s equity can be invested in any single investment (typically capped at no more than 25% of the total equity value of the fund)

Finally, Limited Buyout private equity firms generate revenue in three ways: Carried Interest – the share of any profits generated by acquisitions made by the fund; once all partners have received a complete return on their initial commitment, any remaining profits are split between the general partner and the limited partners (according to agreed upon formulae); Management Fees – charged by the private equity firm / general partner firm to cover overhead and expenses (legal, accounting, consulting, etc.) associated with conducting due diligence on potential target companies; and, Co-Investments – which allow executives and employees of the leveraged buyout firm to invest on terms equal to those of the other partners.

Of the three types of revenue generating tools, management fees are and have been the most controversial as will be seen in the discussion that follows re: Bain Capital.

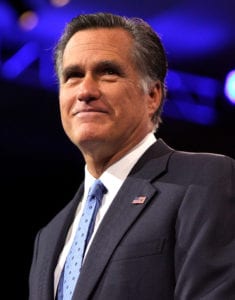

Bain Capital, Inc. and the “Rise” of Mitt Romney:

The history of Bain Capital is relatively short in years but long on controversy.

Bain Capital was founded in 1984 by three junior partners – including Willard “Mitt” Romney, the son of former American Motors President and Michigan Governor George Romney – with the Boston investment firm Bain & Company. In the beginning, Romney was designated as the new firm’s President and Managing General Partner. In the ensuing years – with Romney as the sole shareholder – his titles changed to Managing Director and Chief Executive Officer. The firm spent its first year raising upwards of $37 million in “start-up” funding to finance their new operation ($12 million of the $37 million was contributed by the new partners).

In the early years, Bain Capital’s focus was on venture capitalism (defined as “investments in a project in which there is a substantial element of risk, typically a new or expanding business”) with early investments in start-up companies. The initial fund of $37 million was invested across twenty new or emerging businesses. At the time, Bain’s annualized return on investment was in excess of fifty percent. In 1987, the firm created its second venture capital fund with $106 million raised and spread across an additional thirteen investments. While the company ran each new “fund” as a specific general partnership under the Bain Capital umbrella, Romney’s role as sole shareholder in Bain Capital, Inc. gave him control of and amajor role in each and every one.

Bain’s earliest venture into venture capital investingwas the start-up Staples, Inc., an office supply retail chain that began in 1986 with one office supply “supermarket” located in Brighton, MA. Bain’s initial contribution to the deal was $4.5 million. The company grew rapidly – an IPO that took the company public happened in 1989, just three years after it began. By 1996, the company had grown to 1,100+ stores nationwide. By the end of its 2012 fiscal year, Staples had become one of the largest office supply retailers in the world with: $20 billion in annual sales, $1 billion in net income, 2,295 retail locations and 87,000+ employees. The return on Bain’s initial investment in the Staples start-up was in excess of seven-fold.

During the 1990’s and into the 21st century, Bain’s record was a mixed bag of success and failure. By the end of 1990, Bain Capital had raised over $175 million of investment capital and had invested in thirty-five companies with combined revenues exceeding $3.5 billion. One venture that started out well was Bain’s acquisition of Ampad from the Mead Corporation in 1992. The company experienced moderate growth between 1992 and about 1999 – during that period, a number of related acquisitions grew the company and its revenues. Toward the end of that decade, however, the situation at Ampad began to sour, with employee layoffs, declining sales and revenues, and the closing of production facilities. In December, 2000, the company stopped trading on the New York Stock Exchange (it had gone public in 1996), and a year later it filed for Chapter 11 Bankruptcy.

The company was bought out of bankruptcy by Crescent Investments at a loss for Ampad but at a significant gain for Bain Capital which, at the time of the “distress” sale, held a 34.9% equity stake in the company. In the 8 years under Bain’s control, Bain’s investment generated over $100 million in profits ($60 million in dividends, $40 – $50 million from proceeds from the stock issuance in 1996 and $1.5 – $2 million in annual investment fees).

Sometime around 1989, Bain changed its investment focus from venture capital investments to leveraged buyout and growth capital investments in more stable, mature companies. The Bain investing “model” emerged at that time: buy an existing company with money borrowed against the company’s assets (“leverage”), coopt the company’s existing management into adopting the “Bain methodology” (at the time, not a “hostile takeover” as with other private equity firms) and sell the underlying company for a profit within a few years after purchase.

Throughout the late ‘80’s and ‘90’s, Bain’s profits were attributable to a relatively small number of transactions – the overall success-to-failure rate at the time was relatively even. One study of 68 Bain Capital deals showed that Bain either lost money or broke even on 33 of them. Another 8-year study of 77 Bain deals showed that in 17 instances the company was forced into bankruptcy (22% loss rate); in 6 instances Bain lost the totality of its investments (8% loss rate); but in 10 of the 77 deals studied, Bain’s successes accounted for over 70% of its net profit during the period. Win some… lose some… some taken in a “draw” …

Later in the second decade of its existence, Bain’s modus operandi changed from a “benign” leveraged buy out model to the “hostile takeover” model. In buying going concerns, Bain would leverage them up with debt, sell off productive assets, force plant or store closures, renege on contracts such as those covering pension benefits, and then sell them off for scrap. The results were mixed – Bain’s investors ended up with huge profits, while some 22% of the subject companies ended up in bankruptcy after worker layoffs and “deals” to strip some workers of existing benefits. At the time, one former Bain Capital partner said, “I never thought of what I did for a living was ‘job creation’… The single, primary goal of private equity is to create wealth for our investors”.

While Mitt Romney had always been the sole shareholder of Bain Capital, Inc., his attention to the position began to wane rather early on when he took an interest in a political future. In 1994, he mounted an unsuccessful challenge to Senator Ted Kennedy (D-MA), having taken a leave of absence from Bain for the run. In 1999, Romney took another leave from the company to head up the Salt Lake Organizing Committee ahead of the 2002 Winter Olympics.

Rather than return to Bain after his successful stint as head of the Olympics committee, Romney turned his attention once again to Massachusetts politics, this time with a successful run for the state’s Governorship which he held for just one term. After bowing out of Massachusetts state politics at the end of his term in 2006, Romney next set his sights much higher – the 2008 nomination to be the GOP’s presidential standard bearer. He lost in the primaries to Arizona Senator John McCain who went on to lose the General Election to Barack Obama. Romney did capture the Republican Presidential nomination in 2012, but he and his running mate, Wisconsin Congressman Paul Ryan (later, Speaker of the House of Representatives) went on to lose to the incumbent President by a margin of 51.1% to 47.2%.

In the meantime, his signature company, Bain Capital, Inc. continued in business, again with decidedly mixed results. In the 2012 presidential race, Romney touted his “great successes” with venture capital dealswith companies such as Staples and Sports Authority; those deals were not venture capital deals but, rather, private equity deals where Bain neither owner, managed or ran the acquired companies. The priority in a private equity transaction is to maximize profits, not grow companies or ensure their continued existence. A 2012 Rolling Stone article critical of Romney and Bain Capital (“Why Private Equity Firms Like Bain Really Are the Worst of Capitalism”) scathingly stated:

Here’s what private equity is really about: A firm like Bain obtains cheap

credit and uses it to acquire a company in a “leveraged buyout. “Leverage”

refers to the fact that the company being purchased is forced to pay for

about 70 percent of its own acquisition, by taking out loans. If this sounds

like an odd arrangement, that’s because it is. Imagine a homebuyer

purchasing a house and making the bank responsible for replaying its own

loan, and you start to get the picture.

The Bain methodology was perfected over some three decades – its model became to target profitable, slow-growth companies that were leaders in their markets. After completing a buyout where majority control was ceded to Bain, the new “owners” would begin the real work to come – cutting costs by laying off workers and cutting capital costs (to allow the company to begin paying off its “new debt”).

Over time, the “austerity approach” to ownership and control of “leveraged” companies sounded their death knell. Rather than using profits to expand or to develop new or better products, all “excess revenue” was used to cover existing debt (both new and old). At the same time, companies like Bain stripped already cash-strapped businesses by giving generous dividends to investors (sometimes garnered via further borrowing against a company’s assets) and charging highly exorbitant “management” and “consulting” fees for their “services”. Some have called such schemes “highly inappropriate predatory activities”.

The first decade of the 21st Century saw frenetic activity by private equity firms that resulted in a “buyout boom” theretofore unseen. The number of leveraged buyout deals in that period exceeded the total number of such deals up to that time. Bain Capital was a leader in the rush to acquire and dispose of targeted businesses. The money that flowed into and through such deals was epic and unheard of, as was the “leverage” that was used in most of the acquisitions.

In 2004, Bain joined two other firms to put together the leveraged buyout of the giant toy retailer, Toys ‘R Us, a deal worth $6.6 billion (the history of that transaction would wax and wane over the years until the present time when the retail giant has ended up in bankruptcy and shuttered all of its 1,600+ stores – at the time of Bain’s acquisition, such dire consequences were unforeseen and not on the horizon). Bain’s acquisition in 2005 for $11.3 billion (along with 6 other private equity partners) of Sunguard set a then-record second only to the earlier RJR Nabisco leveraged buyout. It was also the largest and most expensive buyout of a technology company in history.

The year 2005 also saw Bain’s participation in a three-way buyout of Dunkin Brands, Inc., the parent company of Dunkin Donuts and Baskin-Robbins – that transaction was pegged at $2.425 billion in cash. One of Bain’s biggest and most controversial deals occurred in 2006, with the acquisition of Hospital Corporation of America (“HCA”) for $31.6 billion. That transaction was another record-setting deal, exceeding by double the previous RJR Nabisco deal of a few decades earlier. It would not be Bain’s last record setter.

As the 21st century progressed from year-to-year, the acquisitions by Bain Capital continued apace in the “boom private equity” market. Bain was involved in the following leveraged buyout deals during that period:

- In January, 2006, $2 billion buyout transaction for Burlington Coat Factory

- In August, 2006, $6.4 billion paid for 81.4% share in Philips’ semiconductor unit

- In October, 2005, $6 billion leveraged buyout of Michaels Stores

- In February, 2007, $3.5 billion leveraged buyout of African retailer Edcon

- In June, 2007, $10.3 billion (later reduced to $8.5 billion) leveraged buyout of HD Supply (subsidiary of Home Depot)

- In June, 2007, $1.9 billion + buyout of musical equipment retail chain, Guitar Center

Between 2007 and March of this year, Bain was involved in many multi-million and billion dollar leveraged buyout transactions – some of the more well-known companies are: Clear Channel Communications (2008), D & M Holdings (2008 – $442 million), Gymboree (2010 – $1.8 billion), Genpact, Ltd. (2012 – $1 billion – 30.49% equity interest), Apex Tool Group (2012 – $1.6 billion), BMC Software (2013 – $6.9 billion), Blue Coat Systems (2015 – $2.4 billion). As of this writing, Bain Capital, Inc. is still in the business of putting together leveraged buyout transactions – the private equity firm no longer includes Mitt Romney who sold out his interests early in the present century to concentrate on the Romney family’s real “business” – politics. Romney is poised to change his state of residence once again from Massachusetts to Utah in order to run for the Senate seat being vacated by longtime Utah Senator Orrin Hatch (R-Utah).

Chapter 11 Bankruptcies – one real legacy of LBO’s:

A basic fact of an LBO is that their highly-leveraged profile often leads to high rates of default that are most likely to occur during economic downturns, interest rate shocks, industry shifts and internal operational disruptions. The foregoing factors almost always result in a serious deterioration in a firm’s cash flow which, in not-so-extreme situations, leads to severe financial distress for the company and often a race to the bankruptcy court. When a highly-leveraged company’s cash flow is strangled for whatever reason, the ability to pay existing debt is severely limited and defaults occur. In some instances, an already debt-laden company will borrow further to stave off a default situation creating a result that piles debt-upon-debt in a likely “no-win” scenario.

Such is the current situation with Bain-controlled Toys ‘R Us, the giant toy retailer that initially filed for Chapter 11 bankruptcy in September, 2017. Last week, the situation for Toys ‘R Us went from “dire” to worse.

A three-firm consortium of investors – Bain Capital, KKR & Company and Vornado Realty Trust – purchased Toys ‘R Us in a 2005 leveraged buyout for $6.6 billion. Of that sum, $1.3 billion wasput up by the three firms and their co-investors. The balance – $5.3 billion – was financed with debt that was placed on the books of the retailer as is typical with LBO’s. That debt included senior loans to Toys ‘R Us in which the investing partners held a substantial stake. The history of the Toys ‘R Us financial distress and resultant plunge into bankruptcy is too lengthy and complicated to relate in this article. What is coverable is how the “end” (i.e. bankruptcy and probable liquidation) is tied to the “beginning” (i.e. acquisition of a controlling interest via a leveraged buyout transaction where massive debt was added to the books of a debt-laden company).

”In the beginning”, the total outstanding debt of Toys ‘R Us was a staggering $7.6 billion that was a combination of its then-existing debt and the “new debt” imposed by the new controlling shareholders. The annual debt-servicing cost for that sum totaled in excess of $400 million. Over the life of Bain’s ownership – 2005 to 2018, or thirteen years – money that could have gone toward boosting declining sales, making improvements in operations, etc., was instead posted to drawing down debt and paying off creditors. In many LBO’s, the existing management of the target company is kept on board – and – “bought off” so that they ignore what is happening to their company at the behest of the new “owners”. This happened with the Toys ‘R Us LBO – the then-CEO was “compensated” as part of the buyout’s terms to the tune of… wait for this… $65.3 million! For what purpose, other than to coopt him and his underlings to toe-the-line of the acquiring “investors” and be complicit in the ongoing destruction of their once-viable company?

”In the beginning”, Bain Capital also “played” the typical LBO “game” of instituting their game plan to transform Toys ‘R Us. Not transforming it in the sense of making it a healthier, more viable and more productive company but, rather, in the form of laying off workers, making shortsighted sales of assets, depleting cash reserves, and the like. Prior to the 2005 LBO, Toys ‘R Us had in excess of $2.2 billion in reserves – as of late 2017, that figure was down to less than $302 million. The cost of servicing the debt that was placed on it by the LBO was an annual depletion of the company’s financial stability. This was a known fact to the executives at Bain Capital and was, indeed, part of the plan from the outset. That’s how “hostile takeovers” work.

So, in September, 2017, the Toy’s ‘R Us plan was to reorganize its operations and finances in Chapter 11 bankruptcy and continue. The company realized that bankruptcies in the retail sector have accelerated in the past several years. The company recognized that the marketplace where it had operated successfully for years had changed due to the rise of online shopping, a shrinking economy, and the ascendance of other sources such as Amazon, WalMart, and other outlets that were eclipsing the sales and performance of traditional big box retailers. Unlike other retailers, Toys ‘R Us had a large presence in overseas operations such as Europe and Asia that was a cause of some concern at the later stages.

An article in USA Today last month listed “5 reasons Toys ‘R Us failed to survive bankruptcy”:

- The company’s debts were too much to bear – “Toys ‘R Us was saddled with heavy debt when Bain Capital and other firms took the company private in 2005… By the time the company was approaching bankruptcy in 2017, it still had about $5 billion in liabilities…”

- Terrible timing – “That Toys ‘R Us filed for bankruptcy in September instead of shortly after the holiday shopping season turned out to be disastrous… During a period in which the company needed to focus primarily on executing a strong holiday season, the bankruptcy case was an epic distraction…”

- Competitors turned up the heat – “The demise of Toys ‘R Us is just another reminder that retail is a brutally competitive business… Amazon, WalMart and Target all ratcheted up toy discounts – deep discounts – during the 2017 holiday season (as Toys ‘R Us said in a bankruptcy court filing) …”

- Vendors got skittish – “In retail, nervousness is contagious. Although details were unclear, Toys ‘R Us said it faced unexpected ‘delays and disruptions’ in product supplies during its bankruptcy. As the company teetered, vendors apparently worried that the company would not make good on payments it had promised…”

- This time was different – “With the bankruptcy filing in September, the holiday shopping season was always likely to be absolutely critical for Toys ‘R Us. And it was. But the 2017 holiday shopping season was different than any other…”

As recent as two to three months ago, Toys ‘R Us was frantically (and futilely) attempting to renegotiate its debt agreements with its creditors. When it was reported that the company was “flirting with bankruptcy” vendors and investors began to panic. The vendors began seeking upfront cash payment for their deliveries, and in some cases requiring that all outstanding balances be zeroed out before shipments would be made.

On the creditor side, bond prices took a nose dive (down to just 18% of their face value) and the upfront costs for debt insurance rose an astronomical 2,500%. Against those factors, and others heretofore mentioned, Toys ‘R Us and its future seemed doomed. They were not alone. Just this year, there have been thirty-five retail bankruptcies. Many of these bankrupt retailers have been purchased in leveraged buyouts coming out of bankruptcy. Some of those include The Limited, Payless Shoe Source and Wet Seal.

This was not Bain’s first foray into toy retailing, nor is it the first time one of its toy retailing investments went totally bust. About 12 years ago, a very similar thing happened to another Bain Capital LBO – KB Toys. At the time it filed for Chapter 11 bankruptcy, KB Toys was the second largest toy retailer in the country. Again, as with Toys ‘R Us, typical moves out of the LBO “playbook” took a once viable and stable company and all-but-drove it into the ground via the U.S. bankruptcy system.

A recent article at inthetimes.com (“How Private Equity Killed Toys ‘R Us”) pointed the finger directly at private equity firms such as Bain Capital. It said, in pertinent part:

Private equity groups have played a significant role in this downward

turn for retail. But they are not the only culprits: corporate executives

are often let off the hook despite their corruption and complacency

in such takeovers. Private equity might be a more vulgar form of

managerial exploitation, but its pathologies are the same. Cut-rate

wages, insecure jobs and rigid hierarchical decision-making.

Conclusion:

The above quote applies to Bain Capital and the Toys ‘R Us demise. As of this writing, there appears to be no future for Toys “R Us except, perhaps, in a few overseas market areas and Canada. Liquidation seems to be the reorganization “plan”, and that does not bode well for Bain Capital and its remaining co-investors. Recall, that Bain and the two other private equity firms sank $1.3 billion of their own funds into the venture at the outset – analysts are presently saying that those funds will be a total loss to Bain and the others. On the “plus” side, however, Bain and the others took in more than $470 million in fees from the toy giant over their 13-year period of ownership. For some, $470 million over that short a period of time ($36,153,846.00 per year) would represent more than a “comfortable return”, but not, one would guess when offset by a $1.3 billion loss.

Considering that at one time, 22%+ of Bain’s LBO’s ended up in Bankruptcy Court, the “loss” of Toys ‘R Us should not be all that shocking to those who watch private equity investments. The total loss to Bain on account of those failures is not publicly available – but – given the loss in this one deal alone, such losses over the long haul could not have been a benefit to Bain’s bottom line and overall record. Granted, having 78% of one’s LBO takeovers NOT result in bankruptcy or outright liquidation is something that surely lightens the load on the people at Bain Capital today.

Not long ago, one market watcher noted that “Leveraged buyouts have had a notorious history, especially in the 1980’s, when several prominent buyouts led to the eventual bankruptcy of the acquired companies. This was mainly due to the fact that the leverage ratio was nearly 100% and the interest payments were so large that company’s operating cash flows were unable to meet the obligations…”. The foregoing has been said more than once in the preceding pages of this article but it bears repeating here because it is a central fact of the Bain / Toys ‘R Us example above and a central fact of most LBO’s of the “hostile takeover” variety that became so popular in the 1980’s. That the same type of financing is still in vogue at this stage of the 21st century – with the same results in many cases – should serve as a warning to so-called “savvy investors” of today and in the future.

The watchword “caveat emptor” applies…

Image credit: Wikipedia, Toys”R”Us, aquir / 123RF Stock Photo