Category: Chapter 13

Bankruptcy Waiting Periods

—

by

CHAPTERS WAITING PERIOD 7 TO 7 8 YEARS FROM PREVIOUS FILING 13 TO 13 2 YEARS FROM PREVIOUS FILING (CASE MUST BE CLOSED) 7 TO…

CHAPTER 7 BANKRUPTCY TREATMENT OF SECURED PROPERTY

—

by

STATEMENT OF INTENTIONS IN BANKRUPTCY In a Chapter 7 bankruptcy, the debtor must complete and sign a form called the Statement of Intentions. The Statement…

Taxes and tax liens in bankruptcy

—

by

WHEN TAXES MAY BE DISCHARGED IN BANKRUPTCY This article discusses the treatment of taxes due to the Internal Revenue Service (IRS). Income taxes due to…

Hurricane Irma And Bankruptcy

—

by

By Jay Weller Natural disasters and hurricanes and bankruptcy filings within affected areas are intuitively correlative. One would expect that the economic and property damage…

BANKRUPTCY ASSISTANCE

—

by

Bankruptcy assistance and representation in Chapter 7 Bankruptcy, Chapter 13 Bankruptcy, and most avenues to address issues with debt, are available here at Weller Legal…

FAMILY OR HOUSEHOLD SIZE IN BANKRUPTCY

—

by

The bankruptcy code does not contain a definition of family or household size. Under the 2005 Bankruptcy Abuse and Consumer Protection Act, Congress provided for…

FREE BANKRUPTCY CONSULTATION

—

by

Free bankruptcy consultations are offered by Mr. Jay Weller at Weller Legal Group PA. Mr. Weller has practiced almost exclusively bankruptcy law beginning in 1993,…

TAX REFUNDS IN BANKRUPTCY

—

by

The treatment of tax refunds is a popular issue in bankruptcy. Income tax refunds are commonly considered to be part of the bankruptcy estate. Therefore,…

DOMESTIC SUPPORT OBLIGATIONS BANKRUPTCY

—

by

Another important exception to bankruptcy is domestic support obligations. Domestic support obligations are not discharged in bankruptcy and are therefore referred to as an exception…

BANKRUPTCY EXCEPTIONS TO DISCHARGE

—

by

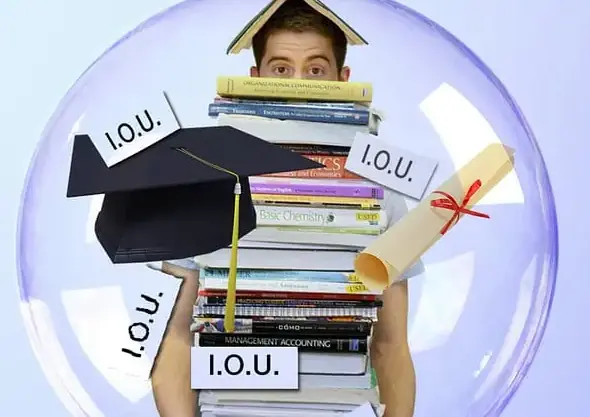

CREDIT CARDS, CHILD SUPPORT, ALIMONY, STUDENT LOANS, TAX DEBTS, INTENTIONAL TORTS, FRAUD Most debts are eligible for Discharge under the Bankruptcy Code. However, Bankruptcy Code…

COPYRIGHTS IN BANKRUPTCY

—

by

Under bankruptcy law, copyrights and patents are considered assets. An author of a book who has copyrighted such book or a songwriter who has copyrighted…

COSIGNER LIABILITY ON STUDENT LOANS, CHAPTER 13 BANKRUPTCY, AND NEGATIVE CREDIT REMARKS – Part II

—

by

When the cosigner of a student loan files Chapter 13 bankruptcy such debtor will often offer to pay a portion of the student loan through…