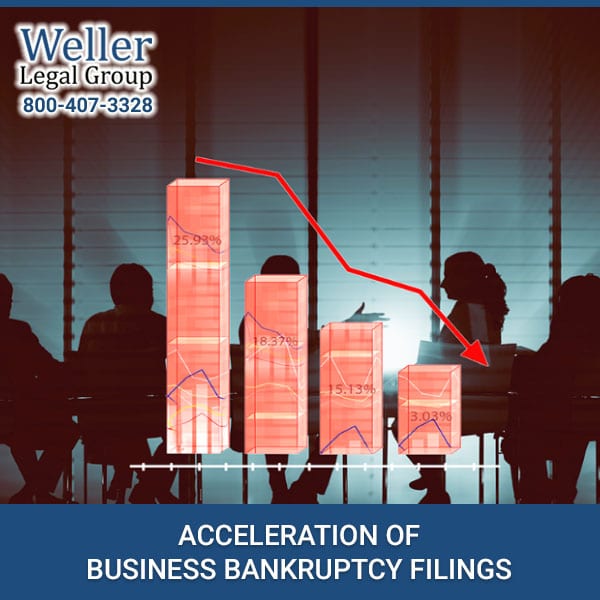

Acceleration of Business Bankruptcy Filings

Running a profitable business is always hard work, and unfortunately, the coronavirus pandemic has made it even harder. The number of businesses that have filed for bankruptcy has skyrocketed since lockdowns began, and the rate has shown few signs of slowing. Business bankruptcy filing rates this year have been the highest since 2013 and surging cases of Covid-19 across America point to the elevated rates remaining high for the foreseeable future. If you own a business that is struggling with debt due to the coronavirus Read More +