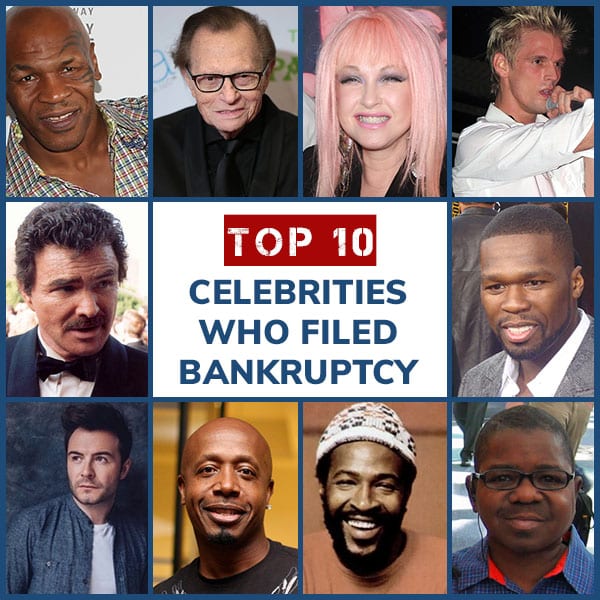

the Average Millionaire Filed Bankruptcy 3.5 Times?

Going through a bankruptcy can be a stressful and time-consuming situation. We at The Weller Legal Group are here to help make the bankruptcy process easier and more efficient for you and your family. A common statement in the bankruptcy world is that, “the average millionaire will file for bankruptcy 3.5 times in their lifetime.” In this article, we are going to discuss this topic of how many times millionaires will file for bankruptcy in America? Millionaire Facts In this section we are going to Read More +